This interest earned on interest results in the maximisation of returns over time. Despite his initial problems with the regimented style of school, Einstein strongly valued the cognitive skills he gained https://www.business-accounting.net/basis-of-assets/ from his later studies. He cited a good college education with providing the type of cognitive skills that allows people to think for themselves and imagine possibilities that have never been imagined.

Article Tags

The 10 extra dollars are due to compounding as you have earned a return on your return. This doesn’t seem like very much but the secret with compounding is to amplify it by investing for long periods of time. If you invest the same $1000 the price earnings ratio calculating dollars in your superannuation at a 10% return and leave it for 30 years your compounded total is $17,449. The power of compounding helps a sum of money grow faster than if just simple interest were calculated on the principal alone.

Disdain for cult of personality

While compound interest is interest-on-interest, cumulative interest is the addition of all interest payments. Banks benefit from compound interest lending money and reinvesting interest received into additional loans. Depositors benefit from compound interest receiving interest on their bank accounts, bonds, or other investments.

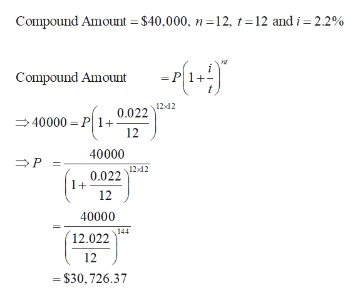

Approach Two: Fixed Formula

“The value of a college education is not the learning of many facts but the training of the mind to think,” Einstein was quoted in the New York Times in 1921. The Rule of 72 is an easy compound https://www.accountingcoaching.online/ interest calculation to quickly determine how long it will take to double your money based on the interest rate. Simply divide 72 by the interest rate to determine the outcome.

Simple interest is when the interest you earn or pay stays the same each year (if there’s no change in the rate of interest paid or charged, and principal remains the same). First, we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

- Compound interest can significantly boost investment returns over the long term.

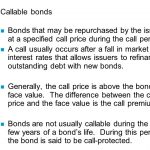

- Investors can also get compounding interest with the purchase of a zero-coupon bond.

- There is no question that Einstein enjoyed the personal freedom to succeed in the United States afforded by the country’s capitalist underpinnings.

- The 10 extra dollars are due to compounding as you have earned a return on your return.

- Einstein might have more to offer today’s thinking saver than just compound interest.

- This should always be considered when reviewing long-term projections.

Compounding basis

By age 65, your twin has only earned $132,147, with a principal investment of $95,000. Compound interest can significantly boost investment returns over the long term. Over 10 years, a $100,000 deposit receiving 5% simple annual interest would earn $50,000 in total interest. But if the same deposit had a monthly compound interest rate of 5%, interest would add up to about $64,700.

To help consumers compare retail financial products more fairly and easily, many countries require financial institutions to disclose the annual compound interest rate on deposits or advances on a comparable basis. The effective annual rate is the total accumulated interest that would be payable up to the end of one year, divided by the principal sum. These rates are usually the annualised compound interest rate alongside charges other than interest, such as taxes and other fees. In investing, compounding is simply the concept of earning a return on your previous returns. A quick example is that if you invest $1000 for one year at a 10% return you will have $1100 at the end of the year. After earning this $100 you decide that you want to do the same thing for the next year and reinvest your principal ($1000) and return ($100) and earn 10% again.

For Einstein, advanced education is not job training, but training to perform at high levels in any situation, job or otherwise. This agrees with my view on education, with its worth being measured in more than just financial return on investment. Would Einstein feel the same way now, with a college education costing several multiples more than it did in his time, even after taking inflation into account? He clearly sees the importance of cognitive ability and education for growing human capital, which has a positive effect on options for long-term wealth.

At a 2% interest rate, it would take 36 years to double your money. At a 12% interest rate, it would only take six years to double your money. I’d argue that taking advantage of compound interest is the single most powerful action that an individual investor can leverage to build wealth.

While it is almost universally agreed that Einstein did not in fact call compound interest the eighth wonder of the world, that does not detract from the criticality of the concept to successful investing. Social security is squarely based on what has been called the eighth wonder of the world—compound interest.

Order your copy of Investopedia’s What To Do With $10,000 magazine for more wealth-building advice. The impact of compounding on fees should also be considered as this can significantly erode the value of your portfolio. This blog explains everyday economics, consumer topics and the Fed. It also spotlights the people and programs that make the St. Louis Fed central to America’s economy.

This economic philosophy doesn’t have a direct relationship with money management, but I thought it was interesting to note. Because of individual freedom, cherished by Einstein, we are able to build wealth for ourselves. In some countries, if our parents were poor servants, we’d be poor servants, too, without any economic mobility. It seems Einstein would not be too happy with the way people revere the most popular financial gurus. Fans of gurus will continue to stand up for their heroes despite displays of lack of character and lack of sense. Fans are invested in their heroes; to admit their guru isn’t perfect is to admit they wasted time, money, and energy.

Compound interest is interest accumulated from a principal sum and previously accumulated interest. It is the result of reinvesting or retaining interest that would otherwise be paid out, or of the accumulation of debts from a borrower. The same logic applies to opening an individual retirement account (IRA) and taking advantage of an employer-sponsored retirement account, such as a 401(k) or 403(b) plan. Start early and be consistent with your payments to get the maximum power of compounding. For loans, you should bear in mind that you will end up paying a higher effective interest rate than the APR if the interest is charged on a compound basis and you are not able to make overpayments to offset this. Compounding is a process where interest is credited, not only to the original ‘principal’ amount, but also to previously earned interest.