The AutoFile feature makes filing automatic, so you are always accurate and on time with filings. More than 15,000 businesses and developers to date worldwide use TaxJar. With QuickBooks, you gain access to a range of top accounting features including monitoring your cash flow and generating invoices. You can also receive sales forecasting reports and track mileage.

A Detailed Guide to Amazon Accounting for FBA Sellers

Also, other reports, including profit margin, inventory, and taxes, are included. Notwithstanding that Wave’s invoicing features make it a very attractive alternative for service-based enterprises, this accounting software for small businesses does have certain restrictions. You see, a single-entry accounting system only logs transactions once.

Simple Financial Reports For Powerful Business Insights

QuickBooks was founded to cater to small businesses specifically. Since then, it has expanded to serve big businesses very well. You can use QuickBooks on many different platforms, which is very convenient. You can also manage your sales from anywhere because it’s cloud-based. Use this tool for the basics like tracking expenses and drafting invoices all the way to bank reconciliation and monitoring financial reports.

Additional languages

FreshBooks has multiple package options so you can pick the one that best suits your business needs and budget. FreshBooks integrates with lots of apps you already use (and some new ones you’ll be glad you found) to make running your business a breeze. FreshBooks stores the expenses in the cloud and organizes expenses entered so that how to calculate owner’s equity you can view profits and expenses on the go. You can sign up for Xero’s 30-day free trial before subscribing to a plan. If you’re looking for a big deduction at year’s end, look for other ways to boost your expenses. Support is amazing, fast, patient, dedicated, smart, and always listens to what accounting partners have to say.

Xero was founded with the intention to help small businesses. Compare features, pricing, and expert reviews for your business software needs – all in one place. Many or all of the products featured here are from our partners who compensate us.

- You may want to do this more often if your business is prone to volatility or you are in uncertain times – like a global recession and pandemic.

- If you’re looking for a big deduction at year’s end, look for other ways to boost your expenses.

- To access more comprehensive features like advanced reports, cash flow forecasts, and the ability to send quotes and estimates, you’ll need the middle-tier Standard plan for £28/month.

- You must include all expenditures involved in creating or purchasing the things you have sold.

In addition, it is simple for them to organize the workflow and streamline the payment process. The users can customize invoices and integrate them into the mail. While many software applications are available, it’s important to know which are useful and which are just gimmicks. We have seen several different successful eBay QuickBooks integration methods.

Large or multi-site merchants may appreciate QuickBooks Online’s wealth of accounting tools. QuickBooks Online’s reporting function enables sellers to create thorough information https://www.personal-accounting.org/ on profit and loss (P&L), inventory expenses, freight, and waste in real-time and with no effort. The software’s inventory management tool is another notable feature.

The Established plan for $60 per month covers the features of the Growing plan and adds support for multiple currencies and specific expenses and projects. Xero is a cloud-based accounting software perfect for online businesses, particularly sellers who require an easy-to-use tool capable of managing banking, invoicing, and cash flow monitoring. Xero is mobile, so you can do all your accounting tasks on the go.

This tool also includes strong reporting that offers standard reports like expenses, profit and loss, and sales tax summaries. You can also link several checking and/or savings bank accounts to the software to get all the transactions there instantly and accurately recorded in the app. You can track multiple currencies, too, and you don’t need a separate inventory management solution. Xero offers a free 30-day trial period, and you don’t pay any setup fees or upgrade fees. The Early plan costs $9 per month and covers 5 invoices, quotes, and bills. The Growing plan is $30 per month for unlimited bills, invoices and quotes, and bank transaction reconciliation.

The advice you receive from your accountant and bookkeeper will only be as good as the information you share with them about your business, growth objectives, and challenges. For example, if you only give them basic information, they are going to provide you with more general advice and best practices. There are tons of nuances around payroll taxes, and it is one of the few things – along with student loans – that can be discharged even if you file bankruptcy.

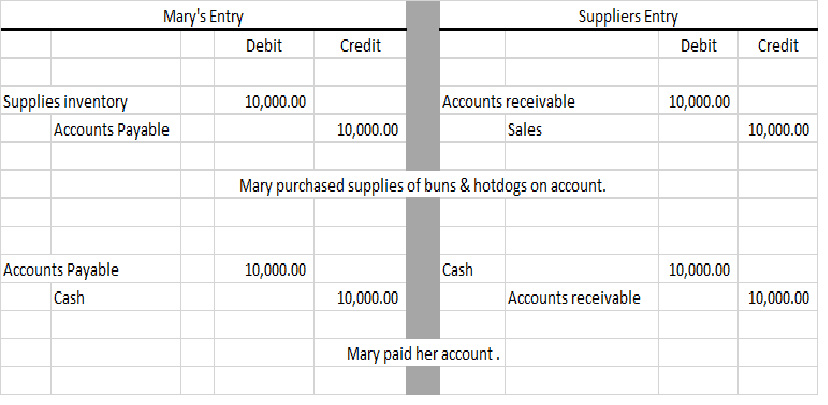

The primary difference between cash-based and accrual-based accounting is timing. In addition to doing your taxes, you need to have accurate bookkeeping records. When you run into https://www.quick-bookkeeping.net/irs-tax-scam-or-impersonation/ problems, this can range from cash flow shortages, late payments to suppliers, or payroll problems. Find an expert ecommerce accountant or bookkeeper on the A2X Partner Directory.

Accurately account for taxes by assigning rules to every transaction type, taxable or non-taxable sales, and country. Get auto-categorized summaries of your sales, fees, taxes, and more matched to deposits in QuickBooks Online, Xero, Sage, or NetSuite. On top of that, you are likely to encounter many manual errors.