AI and automation are streamlining operations and enhancing data management and compliance, improving efficiency and decision-making in financial services. The rise of hybrid models integrates outsourced services with in-house https://www.intuit-payroll.org/ operations, optimising cost efficiency and operational flexibility. In 2024, as AI technology advances, data security becomes a critical priority for businesses using cloud-based outsourced bookkeeping and accounting services.

Receive Detailed and Accurate Financial Reports

The third party can be dedicated outsourcing companies from your home (onshoring), a foreign country (offshoring), or individual freelancers. Introduction The increasing integration of technology in financial services highlights the growing i… Statutory reporting is the legal requirement to submit certain information regarding your company’s finances and activities. Your business might need an experienced partner to help you with these tasks.

What are the benefits of outsourced accounting?

- An accounting company will have access to the best cybersecurity technology, ensuring you avoid data theft.

- It’s essential for entrepreneurs to stay updated on accounting outsourcing trends and cyber threats, which are growing more sophisticated.

- Hiring a finance team from your local talent pool is not always an option because their skills and experience may be limited.

- Along with offering the typical outsourced bookkeeping services, AccountingDepartment.com provides outsourced controller services.

However, Merritt can still recommend a solid payroll provider or tax consultant who meets your needs. That means you won’t get to spend as much face-to-face time with your accountant as you would if they were your employee. If you’re bringing in an outsourced controller to help manage your existing team, it’s necessary to carefully consider what this relationship will look like. If you’re the type of person who likes to shake someone’s hand and look them in the eye, the remote nature of outsourced accounting may require some adjustment.

Resources for YourGrowing Business

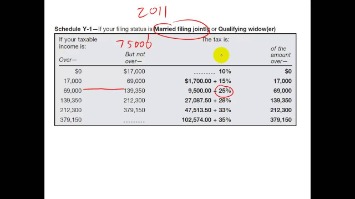

Outsourcing your tax needs to a professional can save you time, reduce stress, and potentially lower your tax liability. These experts will make sure that all necessary forms are filed accurately and on time, minimizing the risk of costly penalties or audits. They can also help identify tax-saving opportunities that you may have overlooked, translating into more money in your pocket. As you pilot your startup, the last thing you want is to get bogged down in the nitty-gritty of financial subtleties.

Compare runner-up bookkeeping service features

The global business process outsourcing market worth is projected to reach an all-time high of $405.6 billion by 2027. That’s an unfathomable amount of money directed towards outsourcing services. It’s also a good indication that many businesses choose to outsource one or more of their business processes to an outside entity of their own.

Advantages of outsourced accounting

Hiring an outside firm might be your best bet if you’re a small company without the resources to spare. They have access and expertise that can’t always come together inside one organization- which means better quality work at a lower cost than if everyone were on staff. Professional outsourced tax accountants have the expertise to ensure you comply with all local and federal laws.

An accountant is an important resource, not only at tax time but also for regular financial planning and forecasting. While most small businesses don’t need to hire an accounting professional full time, that doesn’t mean you should do it yourself. A firm can look out for things like tax credits, specialized loans, and other financial activities that a self-serve software won’t be able to provide guidance on. Yes, external accountants can see the “big picture” outside of your focused scope, helping you spot red flags or notify you about an incoming issue you may not have realised.

Live ChatMonitoring is a BPO company with headquarters in Australia that offers 24/7 live chat support to companies of all kinds, from software development to consumer products. These outsourced teams swaps and other derivatives usually consist of skilled professionals with the right equipment to expertly handle your work from the get-go. When you hire an outsourced team, you don’t have to invest in training and setup costs.

Profitline USA believes managers can make better decisions when the books are in great shape and financial processes are stable. Its accounting and bookkeeping experts remain dedicated to providing outstanding, efficient, and professional services. The key benefit of an outsourced financial controller is that you get the expertise of a CFO without the full-time commitment and cost. This gives you the flexibility to access top-level financial management without sacrificing precious resources that could be used elsewhere in your business. As your business grows, so does the complexity of managing employee compensations, benefits, tax withholdings, and compliance with various labor laws.

For this, the company offers an AI digital platform to manage communications with organizations, stakeholders, and customers. Based out of the United States and Philippines, SupportNinja is a cutting edge outsourcing company that lends support to startups and businesses around the world. It offers customer service, content moderation, and back-office support to companies. With headquarters in California, Nearsol initially provided telecommunication services for real estate businesses.

Automating routine tasks allows finance professionals to focus on strategic analysis and decision support, driving business growth. Units Consulting Ltd. combines quality cost-effective accounting, bookkeeping and payroll services to help companies make and save more money. That is why, when it comes to fees, you will find our accounting company are completely transparent. As you navigate the complexities of your startup’s financial landscape, remember that finance and accounting outsourcing is more than just a convenience.

Typically, the lower your expenses (and the fewer your accounting needs), the less you’ll be charged. Ignite Spot Accounting delivers heftier reports than many other cloud accounting providers we checked https://www.accountingcoaching.online/using-debit-and-credit-golden-rules-of-accounting-2/ out for this piece. Along with typical financial reporting (like profit and loss reports and balance sheets), you’ll get a KPI (key performance indicator) report and profitability analysis, among others.

With plans starting at $15 a month, FreshBooks is well-suited for freelancers, solopreneurs, and small-business owners alike. When you hire an external accountant, you will have access to their specialised skills and the wealth of knowledge they have accumulated over the years they have spent working in the field. Outsourcing your accounting and financial admin can unload some of that burden. So you shouldn’t feel like you have to handle all the finances in your small business. You know, those times of the year when coffee becomes your best friend and the office practically turns..

Complimentary ProposalTo take a test run of our outsourced accounting services, we offer you a free, no-obligation proposal. No one knows the challenges of managing your company’s finances better than you. Making sense of your numbers can be time-consuming and frustrating, to say the least. It’s no wonder so many small business owners have turned to outsourced accounting services for relief. To make important business decisions, leaders need access to timely, precise financial data. An outsourced accounting firm provides exactly that with real-time financial dashboards, monthly reports, support with long-term financial planning, and more.

Many small businesses fail within their first year of operation because the owner tries to do everything on their own. Running an effective company requires diligence and focus, and accounting is often a complicated, time-consuming task that takes more work than a single person can do. If you do decide to pay a third party to handle your accounting, be aware of the potential for scope creep.